The Dupont Identity Can Be Used to Help a Financial Manager Determine the

The DuPont Equation

The DuPont equation is an expression which breaks return on equity down into three parts: profit margin, asset turnover, and leverage.

Learning Objectives

Explain why splitting the return on equity adding into its component parts may be helpful to an analyst

Cardinal Takeaways

Key Points

- By splitting ROE into 3 parts, companies tin can more than hands understand changes in their returns on equity over time.

- As profit margin increases, every sale will bring more than money to a company's lesser line, resulting in a higher overall return on equity.

- As asset turnover increases, a visitor volition generate more sales per asset owned, resulting in a higher overall return on equity.

- Increased financial leverage will also lead to an increase in return on equity, since using more debt financing brings on higher interest payments, which are revenue enhancement deductible.

Fundamental Terms

- competitive reward: something that places a company or a person to a higher place the competition

The DuPont Equation

DuPont Model: A menses chart representation of the DuPont Model.

The DuPont equation is an expression which breaks render on equity downwards into three parts. The proper noun comes from the DuPont Corporation, which created and implemented this formula into their business organisation operations in the 1920s. This formula is known by many other names, including DuPont assay, DuPont identity, the DuPont model, the DuPont method, or the strategic profit model.

![]()

The DuPont Equation: In the DuPont equation, ROE is equal to turn a profit margin multiplied by asset turnover multiplied by financial leverage.

Under DuPont analysis, render on equity is equal to the profit margin multiplied by asset turnover multiplied by fiscal leverage. By splitting ROE (return on equity) into three parts, companies can more than easily understand changes in their ROE over time.

Components of the DuPont Equation: Profit Margin

Turn a profit margin is a measure out of profitability. It is an indicator of a company'due south pricing strategies and how well the company controls costs. Profit margin is calculated by finding the net profit every bit a percentage of the full revenue. As one feature of the DuPont equation, if the turn a profit margin of a company increases, every sale will bring more money to a visitor's bottom line, resulting in a higher overall return on equity.

Components of the DuPont Equation: Asset Turnover

Nugget turnover is a financial ratio that measures how efficiently a company uses its assets to generate sales revenue or sales income for the visitor. Companies with low profit margins tend to have high asset turnover, while those with high profit margins tend to have low asset turnover. Similar to profit margin, if asset turnover increases, a company will generate more sales per asset owned, once once more resulting in a higher overall return on equity.

Components of the DuPont Equation: Financial Leverage

Fiscal leverage refers to the amount of debt that a company utilizes to finance its operations, as compared with the amount of disinterestedness that the company utilizes. As was the case with asset turnover and profit margin, Increased financial leverage will likewise pb to an increase in render on disinterestedness. This is because the increased use of debt as financing volition cause a company to have higher interest payments, which are tax deductible. Because dividend payments are not tax deductible, maintaining a loftier proportion of debt in a company'due south capital structure leads to a college return on equity.

The DuPont Equation in Relation to Industries

The DuPont equation is less useful for some industries, that do not use sure concepts or for which the concepts are less meaningful. On the other mitt, some industries may rely on a unmarried cistron of the DuPont equation more than others. Thus, the equation allows analysts to determine which of the factors is dominant in relation to a company's return on equity. For example, certain types of high turnover industries, such as retail stores, may have very low profit margins on sales and relatively low fiscal leverage. In industries such as these, the measure of asset turnover is much more important.

High margin industries, on the other hand, such every bit fashion, may derive a substantial portion of their competitive advantage from selling at a college margin. For high terminate fashion and other luxury brands, increasing sales without sacrificing margin may be critical. Finally, some industries, such as those in the fiscal sector, chiefly rely on high leverage to generate an acceptable return on equity. While a loftier level of leverage could exist seen as too risky from some perspectives, DuPont analysis enables third parties to compare that leverage with other financial elements that can decide a company's return on disinterestedness.

ROE and Potential Limitations

Render on disinterestedness measures the charge per unit of render on the ownership interest of a business and is irrelevant if earnings are not reinvested or distributed.

Learning Objectives

Summate a company's return on equity

Key Takeaways

Key Points

- Return on equity is an indication of how well a company uses investment funds to generate earnings growth.

- Returns on equity betwixt 15% and 20% are mostly considered to exist acceptable.

- Return on equity is equal to net income (later on preferred stock dividends just before common stock dividends) divided past total shareholder equity (excluding preferred shares ).

- Stock prices are most strongly determined by earnings per share (EPS) as opposed to return on equity.

Key Terms

- fundamental assay: An assay of a business with the goal of financial projections in terms of income statement, financial statements and health, management and competitive advantages, and competitors and markets.

Return On Equity

Return on equity (ROE) measures the rate of return on the ownership involvement or shareholders' equity of the common stock owners. It is a measure of a company'southward efficiency at generating profits using the shareholders' stake of equity in the business. In other words, render on equity is an indication of how well a visitor uses investment funds to generate earnings growth. It is also unremarkably used as a target for executive compensation, since ratios such equally ROE tend to give direction an incentive to perform meliorate. Returns on equity between 15% and 20% are by and large considered to exist acceptable.

The Formula

Return on equity is equal to net income, subsequently preferred stock dividends merely before common stock dividends, divided by total shareholder equity and excluding preferred shares.

Render On Equity: ROE is equal to after-tax net income divided by total shareholder equity.

Expressed every bit a percentage, render on equity is best used to compare companies in the same industry. The decomposition of return on equity into its various factors presents various ratios useful to companies in fundamental analysis.

![]()

ROE Broken Down: This is an expression of return on equity decomposed into its various factors.

The practice of decomposing return on equity is sometimes referred to as the "DuPont System. "

Potential Limitations of ROE

Only because a high return on equity is calculated does not hateful that a company will see immediate benefits. Stock prices are most strongly determined by earnings per share (EPS) as opposed to return on equity. Earnings per share is the corporeality of earnings per each outstanding share of a company's stock. EPS is equal to profit divided by the weighted average of common shares.

![]()

Earnings Per Share: EPS is equal to profit divided by the weighted average of common shares.

The truthful benefit of a loftier return on equity comes from a company's earnings being reinvested into the business or distributed as a dividend. In fact, return on disinterestedness is presumably irrelevant if earnings are non reinvested or distributed.

Assessing Internal Growth and Sustainability

Sustainable– equally opposed to internal– growth gives a company a better thought of its growth charge per unit while keeping in line with financial policy.

Learning Objectives

Calculate a company's internal growth and sustainability ratios

Key Takeaways

Key Points

- The internal growth rate is a formula for calculating the maximum growth rate a business firm can achieve without resorting to external financing.

- Sustainable growth is defined as the annual percentage of increase in sales that is consistent with a defined fiscal policy.

- Another measure of growth, the optimal growth charge per unit, assesses sustainable growth from a total shareholder return cosmos and profitability perspective, independent of a given financial strategy.

Central Terms

- retentiveness: The act of retaining; something retained

- memory ratio: retained earnings divided past net income

- sustainable growth rate: the optimal growth from a financial perspective assuming a given strategy with clear defined fiscal frame atmospheric condition/ limitations

Internal Growth and Sustainability

The true do good of a high return on equity arises when retained earnings are reinvested into the company's operations. Such reinvestment should, in turn, lead to a high rate of growth for the company. The internal growth rate is a formula for calculating maximum growth rate that a house can attain without resorting to external financing. It's essentially the growth that a firm tin can supply by reinvesting its earnings. This tin be described every bit (retained earnings)/(total assets ), or conceptually every bit the total amount of internal uppercase bachelor compared to the electric current size of the organization.

We discover the internal growth charge per unit past dividing cyberspace income by the amount of total assets (or finding render on assets ) and subtracting the rate of earnings retention. All the same, growth is not necessarily favorable. Expansion may strain managers' capacity to monitor and handle the company's operations. Therefore, a more than commonly used measure is the sustainable growth rate.

Sustainable growth is defined as the annual pct of increment in sales that is consequent with a defined fiscal policy, such as target debt to disinterestedness ratio, target dividend payout ratio, target profit margin, or target ratio of total assets to cyberspace sales.

We find the sustainable growth charge per unit by dividing net income by shareholder disinterestedness (or finding render on equity) and subtracting the rate of earnings retention. While the internal growth charge per unit assumes no financing, the sustainable growth charge per unit assumes yous will brand some utilize of outside financing that volition be consistent with whatever financial policy being followed. In fact, in order to achieve a higher growth rate, the company would take to invest more equity capital, increment its financial leverage, or increment the target profit margin.

Optimal Growth Rate

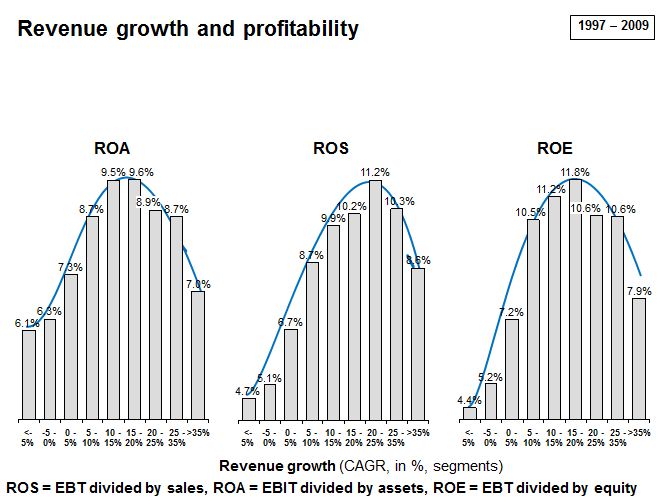

Some other mensurate of growth, the optimal growth charge per unit, assesses sustainable growth from a total shareholder return creation and profitability perspective, independent of a given financial strategy. The concept of optimal growth rate was originally studied by Martin Handschuh, Hannes Lösch, and Björn Heyden. Their report was based on assessments on the performance of more than than 3,500 stock-listed companies with an initial acquirement of greater than 250 million Euro globally, beyond industries, over a menstruation of 12 years from 1997 to 2009.

Acquirement Growth and Profitability: ROA, ROS and ROE tend to ascent with acquirement growth to a certain extent.

Due to the span of fourth dimension included in the study, the authors considered their findings to be, for the most part, independent of specific economic cycles. The report found that return on assets, render on sales and return on disinterestedness practise in fact rise with increasing revenue growth of between 10% to 25%, and then fall with further increasing revenue growth rates. Furthermore, the authors attributed this profitability increase to the following facts:

- Companies with substantial profitability accept the opportunity to invest more in additional growth, and

- Substantial growth may be a driver for additional profitability, whether by alluring high performing young professionals, providing motivation for electric current employees, attracting better business partners, or simply leading to more than self-confidence.

Still, according to the study, growth rates beyond the "profitability maximum" rate could bring about circumstances that reduce overall profitability because of the efforts necessary to handle additional growth (i.e., integrating new staff, decision-making quality, etc).

Dividend Payments and Earnings Retentivity

The dividend payout and retention ratios offer insight into how much of a firm's turn a profit is distributed to shareholders versus retained.

Learning Objectives

Calculate a visitor'south dividend payout and retention ratios

Key Takeaways

Key Points

- Many corporations retain a portion of their earnings and pay the residue as a dividend.

- Dividends are commonly paid in the grade of cash, shop credits, or shares in the visitor.

- Cash dividends are a form of investment income and are ordinarily taxable to the recipient in the year that they are paid.

- Dividend payout ratio is the fraction of net income a house pays to its stockholders in dividends.

- Retained earnings tin exist expressed in the retention ratio.

Central Terms

- stock split: To issue a higher number of new shares to supervene upon sometime shares. This effectively increases the number of shares outstanding without irresolute the market capitalization of the company.

Dividend Payments and Earnings Retentivity

Dividends are payments fabricated by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. On the other paw, retained earnings refers to the portion of net income which is retained past the corporation rather than distributed to its owners as dividends. Similarly, if the corporation takes a loss, and then that loss is retained and chosen variously retained losses, accumulated losses or accumulated deficit. Retained earnings and losses are cumulative from year to year with losses offsetting earnings. Many corporations retain a portion of their earnings and pay the residual as a dividend.

A dividend is allocated as a fixed amount per share. Therefore, a shareholder receives a dividend in proportion to their shareholding. Retained earnings are shown in the shareholder disinterestedness section in the visitor'due south balance canvas –the same as its issued share capital.

Public companies ordinarily pay dividends on a fixed schedule, but may declare a dividend at whatever time, sometimes chosen a "special dividend" to distinguish it from the fixed schedule dividends. Dividends are ordinarily paid in the grade of cash, store credits (mutual among retail consumers' cooperatives), or shares in the company (either newly created shares or existing shares bought in the market). Further, many public companies offer dividend reinvestment plans, which automatically use the cash dividend to buy additional shares for the shareholder.

Cash dividends (most common) are those paid out in currency, usually via electronic funds transfer or a printed newspaper check. Such dividends are a form of investment income and are usually taxable to the recipient in the twelvemonth they are paid. This is the nearly common method of sharing corporate profits with the shareholders of the company. For each share owned, a alleged amount of money is distributed. Thus, if a person owns 100 shares and the greenbacks dividend is $0.fifty per share, the holder of the stock will be paid $50. Dividends paid are not classified as an expense but rather a deduction of retained earnings. Dividends paid practice not prove up on an income statement only practise appear on the balance sail.

Example Balance Sheet: Retained earnings can be found on the balance sheet, under the owners' (or shareholders') equity section.

Stock dividends are those paid out in the grade of boosted stock shares of the issuing corporation or some other corporation (such equally its subsidiary corporation). They are usually issued in proportion to shares owned (for example, for every 100 shares of stock owned, a five% stock dividend will yield five extra shares). If the payment involves the upshot of new shares, it is similar to a stock split in that it increases the total number of shares while lowering the toll of each share without irresolute the marketplace capitalization, or full value, of the shares held.

Dividend Payout and Retention Ratios

Dividend payout ratio is the fraction of net income a firm pays to its stockholders in dividends:

The part of the earnings not paid to investors is left for investment to provide for hereafter earnings growth. These retained earnings can exist expressed in the retention ratio. Retentivity ratio can be found by subtracting the dividend payout ratio from one, or by dividing retained earnings by net income.

![]()

Dividend Payout Ratio: The dividend payout ratio is equal to dividend payments divided by cyberspace income for the same period.

Relationships between ROA, ROE, and Growth

Return on assets is a component of return on equity, both of which can be used to calculate a company'south charge per unit of growth.

Learning Objectives

Discuss the different uses of the Render on Assets and Render on Assets ratios

Key Takeaways

Primal Points

- Return on equity measures the charge per unit of render on the shareholders ' equity of common stockholders.

- Return on assets shows how assisting a visitor's assets are in generating revenue.

- In other words, return on assets makes up two-thirds of the DuPont equation measuring return on equity.

- Capital intensity is the term for the amount of fixed or real capital present in relation to other factors of production. Ascension uppercase intensity pushes up the productivity of labor.

Fundamental Terms

- render on common stockholders' equity: a fiscal year's net income (after preferred stock dividends only before common stock dividends) divided by full equity (excluding preferred shares), expressed as a pct

- quantitatively: With respect to quantity rather than quality.

Return On Avails Versus Render On Disinterestedness

In review, return on disinterestedness measures the rate of return on the buying interest (shareholders' disinterestedness) of common stockholders. Therefore, it shows how well a visitor uses investment funds to generate earnings growth. Render on assets shows how profitable a company's avails are in generating revenue. Return on assets is equal to net income divided by total avails.

Return On Assets: Return on assets is equal to cyberspace income divided by full avails.

This percentage shows what the company can exercise with what it has (i.due east., how many dollars of earnings they derive from each dollar of assets they control). This is in contrast to render on disinterestedness, which measures a house's efficiency at generating profits from every unit of shareholders' equity. Return on assets is, however, a vital component of return on equity, being an indicator of how profitable a visitor is before leverage is considered. In other words, render on assets makes upwards two-thirds of the DuPont equation measuring return on equity.

ROA, ROE, and Growth

In terms of growth rates, we use the value known equally render on assets to make up one's mind a company's internal growth charge per unit. This is the maximum growth rate a firm can achieve without resorting to external financing. We use the value for return on disinterestedness, however, in determining a company's sustainable growth rate, which is the maximum growth rate a business firm can achieve without issuing new equity or changing its debt-to-equity ratio.

Capital Intensity and Growth

Return on assets gives us an indication of the uppercase intensity of the company. "Capital intensity" is the term for the corporeality of fixed or existent capital present in relation to other factors of production, peculiarly labor. The underlying concept hither is how much output can be procured from a given input (assets!). The formula for capital intensity is beneath:

[latex]\text{Majuscule Intensity} = \frac{\text{Total Assets}}{\text{Sales}}[/latex]

The utilise of tools and machinery makes labor more than effective, so rising upper-case letter intensity pushes up the productivity of labor. While companies that crave large initial investments will generally have lower return on avails, it is possible that increased productivity will provide a higher growth charge per unit for the company. Capital intensity tin can be stated quantitatively every bit the ratio of the total money value of upper-case letter equipment to the full potential output. However, when nosotros adjust uppercase intensity for real market situations, such as the discounting of future cash flows, we find that information technology is not independent of the distribution of income. In other words, changes in the retentivity or dividend payout ratios can lead to changes in measured capital intensity.

Source: https://courses.lumenlearning.com/boundless-finance/chapter/the-dupont-equation-roe-roa-and-growth/

0 Response to "The Dupont Identity Can Be Used to Help a Financial Manager Determine the"

Post a Comment